르메르가 해설한 라캉을 읽고 있다. (고금을 통해, 세상엔 천재 새끼들이 너무 많다.)

120여쪽을 더 봐야 하고

쉼없이 써야한다.

그러나 아무런 구상도 없다.

방금 전에 그리고 잠시동안 그것이 존재했던 곳에, 여전히 불타고 있는 소멸과 지연된 탄생 사이에, '나'가 나타나는 동시에 내가 말하는 것으로부터 사라져버린다. 자신을 없애는 발화, 자신을 없애는 진술... 무존재의 존재, 이것이 바로 진정한 생존에 들어있는 이중의 아포리아를 띄고 주체로서의 '나'가 무대에 나타나는 방식이다. 자신에 대한 지식과 담론에 의해서 진정한 존재는 사라지지만 존재는 바로 이 죽음을 통해 유지된다는 것이 이중의 아포리아다. <<에크리, 27>>

24 Articles, Search Results for '2007/05'

- 2007/05/30 2007.05.30

- 2007/05/29 Soldier of Fortune, David Coverdale (Whitesnake)

- 2007/05/28 The Moon is a Harsh Mistress

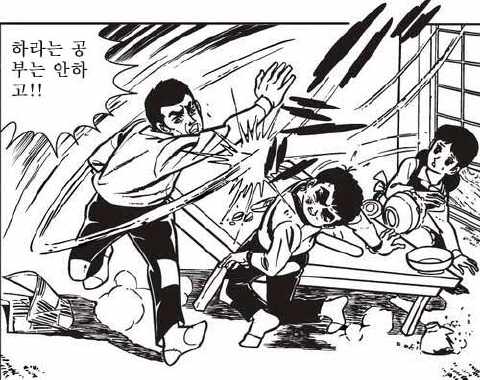

- 2007/05/28 공부하자

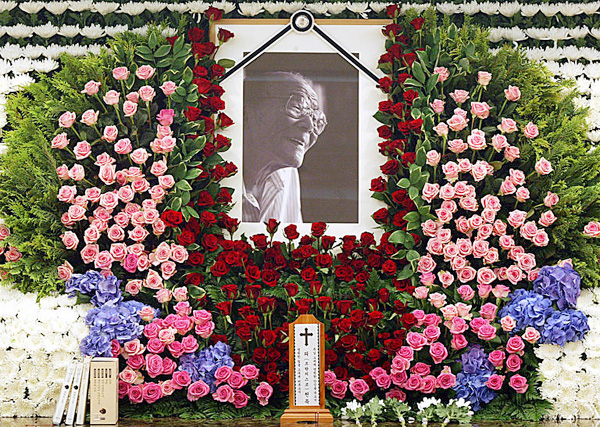

- 2007/05/26 피천득 별세

- 2007/05/26 파인딩 포레스터 (Finding Forrester, 2000) (1)

- 2007/05/25 사랑은 사라지지도, 시들지도 않는 것이다.

- 2007/05/24 Greenspan sees dramatic drop in Chinese stocks

- 2007/05/24 2007.05.24

- 2007/05/21 2006.05.21 (2)

- 2007/05/20 2007 Preakness Stakes (G1)

- 2007/05/19 Horse Chart Definitions

- 2007/05/18 엑소시즘 오브 에밀리 로즈 (The Exorcism Of Emily Rose, 2005)

- 2007/05/17 애절양(哀絶陽)

- 2007/05/17 2007.05.17

- 2007/05/17 Woodstock for Capitalists, 2007

- 2007/05/16 미스뷰티자마 (한) 2007

- 2007/05/16 2007.05.16

- 2007/05/14 에린스아이즈자마 (한) 2007

- 2007/05/11 2007.05.11 (2)

- 2007/05/11 윤동주 시선 (1)

- 2007/05/11 2007.05.11

- 2007/05/06 2007 Kentucky Derby(G1) (2)

- 2007/05/01 The Messiah Will Come Again (3)

Soldier of Fortune, David Coverdale

Soldier of Fortune

Deep Purple

I have often told you stories

About the way

I lived the life of a drifter

Waiting for the day

When I'd take your hand

And sing you songs

Then maybe you would say

Come lay with me love me

And I would surely stay

But I feel I'm growing older

And the songs that I have sung

Echo in the distance

Like the sound

Of a windmill goin' 'round

I guess I'll always be

A soldier of fortune

Many times I've been a traveller

I looked for something new

In days of old

When nights were cold

I wandered without you

But those days I thougt my eyes

Had seen you standing near

Though blindness is confusing

It shows that you're not here

Now I feel I'm growing older

And the songs that I have sung

Echo in the distance

Like the sound

Of a windmill goin' 'round

I guess I'll always be

A soldier of fortune

Yes, I can hear the sound

Of a windmill goin' 'round

I guess I'll always be

A soldier of fortune

The Moon is a Harsh Mistress, Pat Metheny & Charlie Haden

-

▲ 26일 오전 수필가 피천득(皮千得 97) 선생의 빈소가 마련된 서울 송파구 풍납동 아산병원에서 고인의 영정이 가지런히 놓여 있다.

피 선생은 25일 밤 11시 40분 서울 송파구 풍납동 아산병원에서 숙환으로 별세했다 유족은 부인 임진호(89) 여사와 아들 세영(재미 사업가) 수영(울산의대 소아과 의사), 딸 서영씨(미국 보스턴대 물리학과 교수) 등 2남 1녀가 있다. /뉴시스

Somewhere Over The Rainbow/What A Wonderful World, Israel Kamakawiwo'ole

Print This Article | Close this window

Greenspan sees dramatic drop in Chinese stocks

By Jason Webb

MADRID (Reuters) - Former U.S. Federal Reserve Chairman Alan Greenspan said on Wednesday he feared a "dramatic contraction" in Chinese stocks but said the global economy may be able to shrug off a drop in asset prices.

Addressing a meeting in Madrid via teleconference, Greenspan said the recent boom in Chinese stocks could not last.

"It is clearly unsustainable," he said "There's going to be a dramatic contraction at some point."

The main Shanghai index (.SSEC: Quote, Profile, Research has nearly tripled in past year and is up 56 percent so far in 2007.

Greenspan also said a correction could cause problems for Chinese personal wealth. Some analysts have speculated that the Chinese government could be tempted to dip into its reserves to bail out any stung investors and avoid social unrest.

Greenspan, who stood down as Fed governor last year, said cheap Chinese imports were one of the elements stoking world growth, along with Eastern European workers and the knock-on effects on lower inflation and rates.

"In the last five years, the world as a whole is a growing faster than at any time in the world's history," he said. "It can't last and it won't last because it's a one-shot adjustment."

Greenspan said asset prices around the world could fall but that the economy may escape unscathed if it were flexible enough to absorb asset price shocks.

"We will get major declines in certain levels but it need not feed back significantly to levels of employment or the real economy," he said.

Earlier this month, Greenspan reiterated that he believed there was a one-third chance the U.S. economy, the world's largest, would slip into recession this year.

On Wednesday, he said the United States had no problem financing its current account deficit.

"I am ... not particularly concerned about the current account deficit per se. I think that is essentially a market force," he said, adding that the budget deficit worried him more.

Asked about oil prices, which rose strongly last year and were around $70 a barrel on Wednesday, Greenspan said: "The problem of crude oil is not that we're peaking or running out of oil, we're not, the problem of oil is access."

He saw difficulties ahead for world energy markets over coming years if geopolitical issues continued to plague major suppliers and investment remained at insufficient levels.

할 일은 많은데,

비도 오고

부처님도 오셨기에

18시간은 잔 것 같다.

그대들은 내 말을 듣느니 아무 일 없이 쉬는 편이 낫다. 이미 일어난 것은 계속하지 말고, 아직 일어나지 않은 것은 일어나도록 내버려두지 않는다면 그것이 10년 행각해 온 것보다 나은 것이다. 내가 보기에는 그런 많은 일들은 없는 것이며, 다만 평상시에 옷 입고 밥 먹으며 일 없이 시간을 보내는 것 뿐이다. - 『임제록』

| PIMLICO, Saturday May 19, 2007 - Race 12 | |||

| Preakness S. - Grade: 1 | |||

| Purse: $1,000,000 | |||

| Distance/Restrictions: 1 3/16M, Dirt, 3 Year Olds, STAKES | |||

| Winning Time:1:53.46 | |||

| Pgm | Horse | Jockey | Win | Place | Show |

| 4 | Curlin | Robby Albarado | 8.80 | 3.80 | 2.80 |

| 8 | Street Sense | Calvin H. Borel | 3.00 | 2.40 | |

| 7 | Hard Spun | Mario G. Pino | 3.00 |

Times in 100ths: :22.83 :45.75 1:09.80 1:34.68 1:53.46 Unplaced horses listed in order of finish. |

Race Comments: CURLIN stumbled a bit at the start and was unhurried in the early stages while moving to the inside, angled out leaving the first turn, was unhurried while four wide along the backstretch, closed the gap from outside leaving the far turn, circled five wide to reach contention approaching the quarter pole, lagged slightly behind STREET SENSE in upper stretch, dug in under strong urging nearing the eighth pole then battled back gamely under right hand encouragement to get up in the final stride. STREET SENSE tucked in soon after the start, was rated well off the pace for a half, moved out a bit to launch his run at the half mile pole, angled back to the rail while gaining on the far turn, swung out approaching the quarter pole, split rivals while four wide entering the stretch, charged to the front in upper stretch, opened a clear advantage in midstretch, continued on the front into deep stretch then yielded to the winner in the closing strides. HARD SPUN broke a bit slowly, was under a firm hold while ranging up in the early stages, advanced five wide into the backstretch, made a strong middle move under a strong hold from outside along the backstretch, opened a clear lead on the far turn, set the pace into upper stretch and weakened under pressure through the final eighth. C P WEST raced in the middle of the pack while four wide leaving the first turn, gradually gained while continuing wide along the backstretch, closed the gap from outside on the far turn, angled into the three path while just behind the leaders nearing the quarter pole, dropped back a bit in upper stretch and weakened in the final eighth. CIRCULAR QUAY trailed six furlongs, angled four wide while gaining slightly at the three-sixteenths pole then closed some ground with a mild late rally. KING OF THE ROXY was taken in hand while saving ground early, moved out after a half, swung four wide on the turn and lacked a late response. MINT SLEWLEP checked after being bumped off stride at the start, raced well back for six furlongs, swung out in upper stretch and failed to mount a serious rally. XCHANGER broke inward causing crowding at the start, rushed up inside, set the pace along the rail to the far turn and steadily tired thereafter. FLYING FIRST CLASS pressed the pace in the two path between rivals to the half mile pole and gave way. |

Video & Results by www.NTRA.com

| CURLIN 컬린 수 2004 USA 밤색 전적:3(3/0/0) G2  |

Smart Strike 스마트스트라이크 갈 1992 CAN G1 8전(6,1,0) 337,376 USD 511 f, 47sw 3.02 |

Mr. Prospector 미스터프로스펙터 갈 1970 USA *+{BC} LSB 1195 f, 244sw 4.17 |

Raise A Native 밤 1961 USA {B} SW |

| Gold Digger 갈 1962 USA {*} SW | |||

| Classy 'n Smart 클래시앤스마트 갈 1981 CAN {*} SW 9 f, 5 w, 4 sw |

Smarten 흑 1976 USA [B] G2 | ||

| No Class 갈 1974 CAN {*} SP | |||

| Sherriffs Deputy 셰리프스데퓨티 갈 1994 USA Unr 미전(0,0,0) 0 1 f, 1 w, 1 sw |

Deputy Minister 데퓨티미니스터 흑 1979 CAN +[C 1300] LB 1039 f, 83sw 2.83 |

Vice Regent 밤 1967 CAN +[I] LB | |

| Mint Copy 흑 1970 CAN w | |||

| Barbarika 바바리카 갈 1985 USA G2 1 f, 0 w, 0 sw |

Bates Motel 갈 1979 USA [C] G1 | ||

| War Exchange 회 1972 USA SW |

| EQUIPMENT | |||||

| a | Aluminum Pads | j | Aluminum Pad | s | Nasal Strip |

| b | Blinkers | k | Flipping Halter | t | Turndowns |

| c | Mud Caulks | l | Bar Shoes | u | Spurs |

| d | Glued Shoes | m | Blocks | w | Queen's Plates |

| e | Inner rims | n | No Whip | y | No Shoes |

| f | Front Bandages | o | Blinker Off | z | Tongue Tie |

| g | Goggles | p | Pads | 1 | Running W's |

| h | Outer Rims | q | Nasal Strip Off | 2 | Screens |

| i | Inserts | r | Bar Shoe | 3 | Shields |

| Medication Definitions | |

| B | Bute |

| L | Lasix |

| A | Adjunct Medication |

| C | 1st Time Bute |

| M | 1st Time Lasix |

Other Definitions

MTO -Main Track Only. This means the race is scheduled to be run on the turf, and these horses will not actually start. If for some reason the race is moved to the dirt course (the main track) then the MTO horses will start in addition to the others.

Race Card is all races at a track for that day

| RACE RESTRICTIONS | |||||

| R | Restricted | S | Statebred Restriction | A | Auction Restriction |

RACE TYPES (Thoroughbred and Arabian)

SHP

Starter Handicap

This category is reserved for horses that have been running in inferior claiming company, but have improved to the point that they would not be risked being sold in a claiming race. In effect this race is an allowance race restricted to horses that have previously run in a claiming race at a specific level (e.g. starters for a claiming price of $5,000). In a starter handicap race, horses are weighted similar to a handicap race.

STK

Stakes

Races are classified as STAKES races when the meet two basic criteria, 1) They have money added to the base purse of the race in the form of nomination, entry and or starter fees paid by owners; 2) Nominations for a STAKES race must close at least 72 hours prior to its running.

Stakes races can be under allowance conditions (weight off allowed based upon number of wins or money won); handicap conditions (Racing Secretary or Handicapper assigns weight based upon past performances with the goal of giving each horse an equal chance to win the race) or weight for age conditions, (each horse carries equal weights based upon their age and sex).

STR

Starter Allowance

Starter allowance races are identical to starter handicap races with the only difference that horses competing in this race are weighted through allowance conditions (i.e. number of races or money won).

HCP

Handicap

This race type refers to a race where the weights are assigned by the track’s Racing Secretary or Handicapper based upon past performances. Their goal is to assign weight to each horse so that all entrants have an equal chance of winning the race. THERE IS NO ADDED MONEY IN A HANDICAP RACE.

MSW

Maiden Special Weight

These races are reserved for horses that have never won a race. They are not eligible to be claimed. The term special weight is derived from the fact that arbitrary weights are assigned to horses by age. (e.g. 3 year olds 118 pounds, older 122 pounds.)

CLM

Claiming

Claiming races are the most commonly run races in the country. Horses competing in claiming races are offered for sale for a specified priced to eligible buyers.

OCL

Optional Claiming

This race type is quite involved and incorporates features of starter allowance and claiming races. Horses competing in this type of race can either compete as a claimer, or as a starter allowance horse, with no claiming price.

Those competing in this race that are not eligible to be claimed must have competed at or below the claiming level specified, and have not won a race at the specified claiming or higher since last competing at the specified claiming level or a lower claiming price.

MCL

Maiden Claiming

Maiden claiming races are for horses that have never won a race and are eligible to be claimed.

OCH

Optional Claiming Handicap

This type race is an OPTIONAL CLAIMING race that is run under HANDICAP conditions. See both race types listed for a further explanation

MOC

Maiden Optional Claiming

This type race is restricted to maidens (non-winners lifetime) that run under the conditions exactly as those for optional claiming races (see Optional Claiming above).

CLH

Claiming Handicap

A race for horses entered to be claimed, with weight assignments similar to those of a handicap race (see Handicap listed above).

CST

Claiming Stakes

A race for horses entered to be claimed. Nomination and possibly entry and starters fees are added to the base purse.

MAT

Match Race

A match race is a race that involves just two horses. It can be run under a number of conditions, but generally is run in allowance or handicap conditions.

To qualify as a MATCH RACE, only two horses were entered in the race. The race does not qualify as a MATCH RACE if more than two horses originally entered the race and some were scratched, making it a two-horse field. .

TR

Training Race

This race type is to be used ONLY in conjunction with Steeplechase races. The National Steeplechase Association has designated some races run on the "Flat" as TRAINING races.

Past Performance symbols

These symbols are used in past performance lines.

|

indicates a turf race |

|

indicates a state-restricted race |

|

indicates a sealed track |

|

indicates an all weather track |

|

indicates a inner dirt track |

|

indicates a layoff of 30 days or more |

Workout Codes

"b" means "breezing".

"bg" means "breezing from the gate".

"h" means "handily".

Codes for Track Conditions

Turf Conditions:

HD - Hard - Surface is hard and horses do not have normal cushion of the course; frequently follows periods of drought and high temperatures.

FM - Firm - Equivalent to Fast on Dirt Track; course is dry and at peak efficiency.

GD - Good - The drying process continues, times improve and the track is approaching a FIRM condition. Fewer divots may be evident.

YL - Yielding - Usually following some wet weather; horses' hooves dig up the course and divots are flying; times are slower

SF - Soft - Usually following prolonged wet weather; horses' hooves sink in and dig up the course; times are considerably slower.

Dirt Conditions:

FT - Fast - Completely dry and at optimal efficiency.

WF - Wet Fast - Occurs immediately after a heavy rain; track has surface water on it, but the base is still solid, accounting for times similar to (or even faster than) a fast track.

SY - Sloppy - As the track continues to accumulate moisture, the base is still solid but water is beginning to seep into the base; SURFACE WATER IS EVIDENT.

MY - Muddy - Moisture has permeated the base of the track; times are somewhat slower and running tires the horses more.

SL - Slow - The racing surface has begun to dry out; the base is still soft, but surface drying is evident; times are generally slower than normal.

HY - Heavy - Similar to Muddy, track surface is deep and consistency is thick, an obvious slowing of times will be apparent as will the tiring of front runners.

GD - Good - The drying process continues, times improve and the track is approaching a FAST condition. Some flying dust may be evident.

FZ - Frozen - As a result of sustained low temperatures, ice particles have formed on the racing surface.

http://www.equibase.com/newfan/codes.cfm

애절양

哀絶陽

(성기 끊음을 슬퍼하다)

정약용

갈밭마을 젊은 아낙

설리설리 우는 소리

관문 앞 달려가 통곡하다

하늘보고 울부짖네.

출정나간 지아비 돌아오지 못한 일이야

그래도 있을 법한 일이로되

사내가 제 양물을 잘랐단 소리

예로부터 듣도 보도 못하였네.

시부님 삼년상 벌써 지났고

갓난 아인 배냇물도 안 말랐는데

이 집 삼대의 이름이

모두 다 군적에 실렸구나.

관가에 가서 억울한 사정 호소하재도

범 같은 문지기 버티어 섰는데

이정(里正)은 으르렁대며

외양간의 소마저 끌어갔다오.

남편이 식칼 갈아 방안으로 들어가더니

선혈이 자리에 흥건히

스스로 부르짖길

"이 바로 자식 낳은 죄로다!"

잠실궁형(蠶室宮刑)은

어찌 꼭 죄가 있어서던고?

민땅의 어린애 거세하던 풍속

참으로 가엾은 일이었거든

만물이 낳고 살아가는 이치

하늘이 내려주심이니

음과 양이 어울려서

아들이요 딸이로세.

말이나 돼지 불알까기도

슬프다 이르겠거늘

하물며 우리 인간

대 물리는 일 얼마나 소중하냐?

부자집들 일년 내내

풍악 울리고 흥청망청

이네들은 한톨 쌀 한치 베

내다 바치는 일 없거니

다 같은 백성인데

이다지 불공평하다니

객창에 우두커니 앉아

시구편을 거듭거듭 읊노라.

자료 정리를 좀 했다. 꼭 읽어내야할 것들이 남아 있다. 해야할 구상도 널려 있고.

생각해보면 나는 참 나쁜 놈이다.

비가 올때면 더욱 그런 생각이 드는 건,

자괴감이란 수인성전염병이 아닐까.

비오는 날 인질극을 벌인 그도 이 전염병의 희생자는 아니었을까.

나는 神을 믿지 않고

부모를 공경하지도 않는데다

위선자다. -- 덕분에 나쁜 놈임에도 불구하고 한 사회의 무난한 구성원으로 보인다.

神을 속이고 사람을 속이고,

나는 사람보다 동물을 믿는다.

아무리 노력해도 일탈할 수 없음.

그것이 한계고 불행이다.

가는 비 온다

기형도

간판들이 조금씩 젖는다

나는 어디론가 가기 위해 걷고 있는 것이 아니다

둥글고 넓은 가로수 잎들은 떨어지고

이런 날 동네에서는 한 소년이 죽기도 한다.

저 식물들에게 내가 그러나 해줄 수 있는 일은 없다

언젠가 이곳에 인질극이 있었다

범인은 「휴일」이라는 노래를 틀고 큰 소리로 따라 부르며

자신의 목을 긴 유리조각으로 그었다

지금은 한 여자가 그 집에 산다

그 여자는 대단히 고집 센 거위를 기른다

가는 비……는 사람들의 바지를 조금 적실 뿐이다

그렇다면 죽은 사람의 음성은 이제 누구의 것일까

이 상점은 어쩌다 간판을 바꾸었을까

도무지 쓸데없는 것들에 관심이 많다고

우산을 쓴 친구들은 나에게 지적한다

이 거리 끝에는 커다란 전당포가 있다, 주인의 얼굴은

아무도 모른다, 사람들은 시간을 빌리러 뒤뚱뒤뚱 그곳에 간다

이를테면 빗방울과 장난을 치는 저 거위는

식탁에 오를 나날 따위엔 관심이 없다

나는 안다, 가는 비……는 사람을 선택하지 않으며

누구도 죽음에게 쉽사리 자수하지 않는다

Holiday, Beegees

|

Tuesday, May 15, 2007

Matt Stichnoth

bankstocks.com

|

[I was in Omaha, Nebraska on May 5, at Berkshire Hathaway’s annual shareholders meeting. As is tradition Warren Buffett and Charlie Munger spent five hours or so answering attendees’ questions. Here are my notes from the event. ?MMS]

Q: There’s so much money chasing private equity deals now, it looks like a bubble. What could cause it to burst?

WB: I wanted to start crying as you described the situation. You see the difficulty we have finding attractively valued deals. Private equity bubbles don’t, by their nature, burst. If a fund has a time horizon of five years or more (as most do) and its holdings aren’t priced daily (and they aren’t) it will take many years for the score to show up on the scoreboard for investors to see. Because of the illiquidity, investors will take many years to exit from their private equity investments. So it’s not like a bubble in marketable securities. Investors can’t leave. But if yields on junk-grade debt jump relative to high-grade debt, that will slow activity in private-equity investing considerably. Right now spreads are very low. They could widen; that would slow deal activity.

There’s no lack of incentive for fund managers to do deals. If I run a $20 billion fund that gets paid a 2% management fee, that’s $400 million annually in fees. But the manager wants to get that money invested, since he can’t very well go out and ask investors for another $20 billion for his next fund until the first $20 billion is invested. So there’s competition to invest quickly. These investors aren’t really competitors to Berkshire. The math of the deal has to make sense to us. We don’t get paid on activity. It will be awhile before disillusionment with private equity sets in and promoters stop pushing funds. It all depends on availability of money to invest.

CM: These sorts of things can go on long after you’re in a state of total revulsion.

Q: John Templeton recently noted that you’ve missed opportunities over the years in not investing outside the U.S. What would it take for you to start investing globally?

WB: We probably bought our first non-U.S. stock 50 years ago. It doesn’t matter where a company like Coca-Cola is based; what matters is where the company does business. The fact is that we weren’t on the radar screen of very many non-U.S. sellers. In the U.S. early on, no one knew about Berkshire. I didn’t do a good job of selling us as a buyer. Iscar found us. We certainly don’t have a bias against buying non-U.S. businesses. Ethan Wertheimer of Iscar is planning a procedure to help get Berkshire better known outside the U.S.

We own a lot of non-U.S. securities. Two in the German market. We don’t have to report a lot of these because the positions aren’t large enough. We have perhaps a half dozen non-U.S. positions. Reporting requirements in certain other countries sometimes prevent us from investing in them as much as we might otherwise. In Germany, holders must disclose equity positions once they’re 3% or more of a company’s shares outstanding. So if we’re looking at a company with a $10 billion market cap, we’d have to disclose our holdings once they exceeded $300 million. That’s not our favorite thing to do. It can be a real minus.

CM: John Templeton made a fortune by being in Japan early. That’s very admirable. We did OK over the same period.

Q: What fee structure is best to maximize returns for investors over the long term that is fair both to investors and managers?

WB: On the question of executive compensation, the real problems start if you have the wrong managers in place rather than having the wrong system. Any compensation sins are minor compared to having a mediocre guy running the company. But the natural tendency is for there to be a lack of intensity in the bargaining process. The CEO is very interested in his compensation package, but to the comp committee, it’s not as urgent an issue as it is to the CEO. Contrast that with the intensity that goes into labor negotiations, where there are cooling-down periods, and arbitrators, and elaborate PR strategies on both sides. When does that happen when the comp committee sits down to determine how much to pay the CEO? To the comp committee, it’s just play money.

I’ve been on 19 boards, and on just one compensation committee?and the board regretted it. There is no parity if intensity in the bargaining process. What drives high comp is envy, not greed. Pay a guy $2 million per year and he’s happy?until the next guy gets $2.1 million. Of the seven deadly sins, envy is the deadliest. It’s not even fun being envious. At least with gluttony, there’s some upside. We’re going to be gluttonous in a little while, and I’m looking forward to it. And I’m told there’s some upside to lust, too?but I’ll leave that to Charlie.

CM: A lot of the problem is with compensation consultants. I’m reminded of the story of the census taker who knocks on the door, and the little girl who lives there tells him that her father is in jail for embezzlement. Her mother asks the girl why she said that. The girl answers, “Because I didn’t want to admit that Daddy is a compensation consultant.”

Q: I read a study somewhere that said companies that don’t own private jets outperform by 4% per year, on average. What yardsticks do you use to judge the quality of companies?

CM: We’re solidly in favor of private jets.

WB: Charlie travels by bus, but only when he can get a senior citizens discount. Charlie has one NetJets share and I own two shares. Berkshire is much better off with corporate jets. There are deals I likely wouldn’t have made if I didn’t have a jet available to travel on short notice. I wouldn’t have had the same enthusiasm for deals if I couldn’t have gotten on a jet quickly. But they can be misused. I remember one CEO of a consumer marketing company who said the company test-marketed all its new products at the same supermarket in Idaho. This supermarket happened to be nearby a lodge the company owned.

Getting back to the CEO compensation issue for a minute, compensation is not rocket science. It’s very simple to determine what someone should be paid. We pay people based on what’s under their control that we care about, not on what they can’t control. If the price of oil rises to $60 from $30, oil company executives shouldn’t get paid more even though the companies’ earnings rise. If the executive can lower his company’s finding costs, that I’ll pay for. The guy is worth a lot. But the price of oil has nothing to do with it. If oil prices fall, but the company has the lowest finding costs, pay him like crazy.

CM: If the trappings of power are important to the manager, the company’s returns will likely fall. Marcus Aurelius was one of the greatest emperors of Rome, and he didn’t care about the trappings of power. All these perks can be abused. Executives should provide examples of contrary behavior.

Q: Please explain how Berkshire would be affected by a credit contraction and higher interest rates.

WB: We benefit when others suffer. Times of chaos?junk bonds in 2002, stocks in 1974?are good for us. We aren’t likely to see a credit contraction. The authorities won’t do that. We might see an exogenous event that could cause a big rise in spreads, though. If that happens, Berkshire has plenty of cash on hand to put to use. Thirty or 40 years ago during contractions, money simply wasn’t available. Back then during a credit crunch, we found a bank we wanted to acquire. No lender was willing to finance us. The only financing we could find was out of Kuwait, but they wanted to lend us the money in dinars. The problem was that they wanted to be repaid in dinars, as well. Inasmuch as the Kuwaiti lender could pretty much determine the value of dinars in dollar terms, we didn’t think that was a very good idea. We didn’t do the deal.

In the old days, Midwestern banks depended on correspondent banks in New York. So if things went haywire there, banks far away from New York were affected, too. Now, the Fed won’t produce a credit crunch.

CM: Last time there was a credit contraction, we made $3 billion or $4 billion. Jonathan Alter recently wrote a book about FDR’s first hundred days. The country was close to broke at that point. FDR got what he wanted from Congress. The economic situation was chaotic. People were dealing with each other using scrip. We won’t see an orchestrated credit crunch again. In 1998 things seized up, but that wasn’t an orchestrated contraction. People were panicked, and we saw credit spreads widen dramatically. There are lots of people with high IQs and lots and lots of cash. But extraordinary things happen. People panicked, and thought others would panic.

Q: What do you think of John and Abigail Adams?

CM: I’m sure they were nice people, but I’d take Ben Franklin every time. I’m sure people say that I’m more like Adams than Franklin, though.

Q: With profits so high as a percentage of GDP, is it hard to find investment opportunities?

WB: You’re right: corporate profits are near a record level as a percentage of GDP. Typically they range between 4% and 6%. Usually, when they range higher than that, it’s not likely to be sustained. When profits get to 8%, as they are now, that’s very high. But there’s still no political reaction, like a move to raise corporate taxes. Many companies are earning 20% or 25% on their tangible equity at a time when government bond rates are 4% to 6%. Economic texts from 20 years ago would have said that that can’t happen. Someone else’s share of GDP has fallen. The labor component has fallen. Will this become a political issue? Who knows? Congress can change the tax laws. Corporate tax rates used to be 52%. Now they’re 35%, and some companies pay even lower rates than that. Corporate America is living in the best of all possible worlds. History says that the current situation won’t last. Corporate profits won’t stay at 8% of GDP.

CM: Much of those profits are in the financial sector, such as investment managers, banks, private equity investors, and investment banks. It has no precedent.

WB: If you’d have said that with returns on long-term governments at 4 ¾%, that one bank after another would earn 20% or more on its tangible equity, I would have said that that can’t happen. Part of those big returns comes from higher leverage. Banks earn a return on assets of 1.5%, and lever up 15 times, and earn a 22% ROE. But that 1.5% ROA should have been competed away, to maybe 0.9%. But that hasn’t happened. In the past 75 years, corporate profits this high as a portion of GDP only happened one or two years, right after World War II.

CM: Some of the high profitability in the financial sector is due to growth in consumer credit. South Korea had a big collapse after a big push on consumer credit there.

WB: But that collapse produced some ridiculously low stock prices. It was like 1932 in the U.S. Things do turn around eventually. As we look for a successor to me, we want someone who can imagine things he hasn’t experienced before. Some people are very smart, but are not wired to see things that they haven’t experienced.

Q: What can be done about naked shorting?

WB: Failure-to-deliver has never happened to me. I don’t see it as a big problem. We would welcome people shorting Berkshire. We earn money on the lend, and have a sure buyer of the stock at some point. I’ve read that this is supposed to be a problem. If anyone wants to naked-short Berkshire, we’re happy. Short sellers generally have a very tough time of it. At any given time, there are usually more people bulling a stock than there are bearing it. Shorts are no great threat. We can make money on the lend. We did on USG, lending out the stock. They paid us a lot of money on the short, and we were better off as a result. The USG shorts didn’t do to well. It’s a tough way to make a living. It’s very easy to spot a phony stock. But if its boosters can boost its price up fivefold, they can probably boost it tenfold.

CM: Sometimes there is sloth in the clearing process. That’s not good for civilization. It’s kind of like having sloth in the management of nuclear plants. There’s a lot of sloth in derivatives trading. The clearing process could be awful if a lot of people started trading the same contracts at once.

Q: Will gambling companies do well?

WB: Yes?if they’re legal. People have an inherent desire to gamble, including day trading. People like to gamble. If you’re watching a boring football game, if you bet on it it will be a lot more interesting to watch. (We insure against hurricanes, so I watch the Weather Channel.) The propensity to gamble is huge. Before, you had to go to Las Vegas. Now access to gambling is much easier. Forty years ago I bought a slot machine for my house. I’d give my kids an allowance, but it would all be in dimes. I’d have it all back by nightfall. My payout ratio was terrible. That tells you what kind of father I was. But I do think that gambling is a tax on ignorance.

CM: I find it socially revolting when government preys on the weakest of its citizens rather than protects them. When government makes it easy for people to use their Social Security checks to pull the handle on a slot machine, that’s a cynical act. It is not government at its best. Other things will flow from that. Gambling companies are clever psychological tricksters. It’s a dirty business. You won’t soon see Berkshire owning casino companies.

Q: What’s a good way to become a better investor?

WB: Read everything you can. I read every book on investing in the Omaha Public Library. Fill up your mind with competing thoughts and decide what makes sense. Then jump in the water and start investing real money, rather than a paper portfolio. The difference between investing real money and is the same as reading a romance novel and actually dating. There’s nothing like experience. The earlier you start, the better.

I read a book when I was 19 that formed my framework ever since. You have to read a lot in order to be able to recognize which ones jump out at you?and then do some investing yourself.

CM: When Sandy Gottesman interviews prospective employees, the first thing he asks is, “What do you own yourself?” If the interviewee doesn’t have an answer, Sandy tells him he should look somewhere else.

WB: If I look to buy a farm, I’ll figure how many acres it has, and multiple that by the yield I can expect to get per acre, and then multiply that times the price I think I can receive per bushel of yield. I’ll make a quantitative decision whether I want to buy the farm at the price being offered. It won’t be based on what I hear on CNBC or what my neighbor has to say about the farm.

Suppose GM is at 30, and you’re considering buying it. Assume that you’re thinking of buying GM for its market cap of $18 billion. Take a yellow pad. If you can’t write down a good argument for why you should buy GM for $18 billion, then you shouldn’t buy one share, or 1,000 shares, or the whole company. The business exists, and you should assume that you’re buying the business.

If Gottesman’s interviewee did have an answer for “What do you own?,” Sandy would then ask why he liked the stock.

Q: When you look at companies that operate in cyclical or uncertain environments, how do you judge margin of safety?

WB: We like businesses that operate in environments that we think we know the answer. If the environment is so chancy, we don’t try to calculate a margin of safety. If we buy a company like See’s or Coca-Cola, we don’t think we need a large margin of safety. We don’t think we’ll be wrong. We look for businesses that generate a high return on capital employed. We want to own a good business. We’d like to own businesses like that at 40 cents on the dollar, but if we have to pay a dollar per dollar, that’s OK, too.

If a fat guy walks into the room, it doesn’t matter whether we know he’s exactly 300 pounds or 325 pounds?we know he’s fat. If the competitive nature of the business is such that you don’t know the future of the business, then pass. A company’s past results are only helpful if they give you an idea of its future results. Sometimes you’ll be able to buy it at 25 cents on the dollar. If you can buy a good business at a reasonable value, you’ll be OK.

CM: “Margin of safety” means that you are getting more value than you are paying for. It’s as basic as high school algebra. If you don’t understand high school algebra take up another line of work.

Q: How would you fix the health care finance mess?

CM: It’s too tough.

WB: We can’t solve it. We like easy problems. We don’t try to solve tough problems. We don’t go around looking for tough problems. We do little in health insurance. If we did, we’d look for something with low distribution costs and a better ratio of premiums to benefits paid. But it’s a big problem. Health care accounts for 15% of GDP.

Q: How do you calculate intrinsic value?

WB: The intrinsic value of Berkshire Hathaway equals the amount of its future cash flows, discounted at a proper rate.

CM: Investors should estimate the value of our operating subsidiaries, and the value of our marketable securities. That gives you the value of our operating business. But you also need to estimate how effectively we’ll deploy our retained earnings. In 1965, Berkshire’s entire value lay in its prospective reinvestment of its retained earnings into new businesses, not in its textile business. We now have $80 billion in retained earnings to invest.

WB: If Charlie and I wrote down our estimate of Berkshire’s intrinsic value, the numbers would not be the same.

CM: Berkshire’s future won’t be like its past. Its balance sheet has become extreme. The balance sheet is gross compared to how we started. If Warren hadn’t been learning the whole time, the record would be a shadow of what it is. Warren has gotten better since he turned 65. Our system works better than at other companies where, when the CEO turns 65, he hands off to a 59-year-old, who’ll then hand off to another 59-year-old when he turns 65. Our system should be copied more often. Passing power from one old codger to another isn’t necessarily the best way.

WB: You’d be amazed by how many ideas are a reaction to animal spirits.

Q: Please comment on your view of the growth in derivatives.

WB: It’s not derivatives in themselves that are the problem. We have something like 60 positions in derivatives, and we’ll make money on them. But the problem is the usage of them on a rapidly expanding basis. It’s introduced more and more leverage into the system. Back in the 1920s, leverage contributed to and exacerbated the stock market crash. It was like pouring gasoline on a fire. Stocks would fall 10%, and investors would have to sell to meet margin calls, so prices would fall another 10%, and prices would fall some more. Leverage was thought to be dangerous, so the Feds regulated it by, among other things, dictating margin requirements. It was the source of real attention by regulators. The Feds policed it.

Now with the expansion of derivatives, and the regulation of margin requirements has become a joke. It’s an anachronism. I don’t know how or when it will end, but some unpleasant things are going to happen.

We saw it in 1987, with portfolio insurance. It came out of academia?but it was a joke. Basically portfolio insurance was a bunch of stop-loss orders. A joke. The 1987 crash was caused by a doomsday machine. It was a dead hand trading stocks.

But that’s nothing compared to what will happen to the fund operators who are leveraged into the “crowded trade” but don’t realize it. Add that to extreme leverage and you get a very chaotic situation. Who knew what chaos shooting the archduke of Austria would cause? A disruption will happen.

CM: The accounting for derivatives doesn’t help. If you’re paid to generate bigger and bigger phony profits, you’ll keep generating them. Most of the accounting profession doesn’t know that it doesn’t know the risks. If you pay people to mark to model, you’ll get bigger and bigger exposure.

WB: Four years ago our auditors went through General Re’s derivatives book and signed off on the values of the positions. I wish we could have sold the book to the auditors at those prices. If you run a dry cleaning business and I owe you $15, my books will show that I owe you $15, and your books will show that I owe you $15. There are just four major auditing firms left. Often, one firm will audit firms that have opposite positions in the same contract. The valuation of that contract between the two parties should net to zero. But people will game the system. If we mark a position at $1 million on Berkshire’s books, that position should be marked at minus-$1 million at our counterparty’s. But auditors attest to values that aren’t consistent between counterparties.

CM: This will cause trouble in due course.

Q: What do you think about short-term trading?

WB: There’s a huge electronic herd full of people who think they need to decide things every minute. Their trading turnover is high. There’s nothing evil about that, but they’re playing a different game than buy and hold. If you try to beat every other guy, day after day, you’re going to try to trade faster than him, and hit the computer key faster. But that’s not new to the markets. When I was running Salomon, people used to talk about five- or six-sigma events. Smart people do crazy things, en masse. Markets go crazy all the time. But when people try to beat the market day to day, it’s a fool’s game.

CM: When people talk about “sigmas” in controlling risk, they’re all crazy. People want to model potential outcomes according to a Gaussian distribution, because Gaussian distributions are easy to compute and easy to teach. But the real world doesn’t follow a Gaussian distribution. The distributions are bigger and more dramatic. It’s tough to learn all that higher math, and then find out that it has no meaning. That can be frustrating to find out.

Q: How do you determine intrinsic value?

CM: When we try to determine a company’s intrinsic value or its stock’s margin of safety, there’s no one easy method. We use multiple techniques and models. Lots of experience is helpful. You can’t become a great investor without experience.

WB: Suppose you drive 30 miles to look at a farm you’re thinking about buying. You’ll figure what the yield will be, and what fertilizer and labor costs will be, and how much you’ll have to pay in taxes. And you’ll come up with a number that uses all those inputs. If you figure that the farm will generate $75 per acre, what do you pay for the farm? You might assume that your yields will rise over time, or that crop prices will rise. So you might say the farm is worth $1,000 per acre. So if it’s selling for $900 per care, you might buy it, but if it’s selling for $1,200 per acre, you wouldn’t.

We try to figure out what corporate farms are worth, by looking at what they will produce. The basic math of investing was set by Aesop: a bird in the hand is worth two in the bush.

The ability to distribute cash is what gives Berkshire its value. You may have insight into very few businesses. How much more competition will enter the business? How will buyers’ tastes change? Take all that into account, and the business may be worth X, or X-, or X+. But you have to decide, and those of the sorts of things you need to know. You should stay inside your circle of competence.

CM: Most decisions go on our “too hard” pile. If you’re looking for a way to value all businesses, we can’t help you.

WB: We can jump over 1-foot-high bars, but not 7-foot-high bars, and we’re good at recognizing 1-foot-high bars.

Q: What are you looking for in a successor?

WB: It could be three or four people. We might give them all some money to run. We’re not looking for someone that we would teach, but someone who already knows how to do it. One guy wrote to me and nominated his four-year-old son. I know this is so easy that a caveman can do it?but a four-year-old! The biggest problem will be, can they scale up. It’s different running $100 billion than it is $10 billion. You can’t do as well. That doesn’t bother us. But the individual needs to have the ability to run very large sums and do mildly better than the market. We can’t beat the market by 10 points per year. Maybe 2 points better. But we want someone who won’t blow it. If you take $100 billion and multiply it by zero, you end up with zero, regardless of how strong your interim results were. We’ve seen a lot of smart people go broke. Ninety-nine times out of 100, they made great decisions, but once out of 100 they didn’t.

So we’ll give each one $2 billion to $5 billion, and see how they do, and if they do well we’ll scale them up.

CM: It’s like that story about Mozart. A man goes to Mozart and asks him for advice about writing a symphony. Mozart said, “but why are you asking me?” “Because you were writing symphonies when you were ten years old.” Mozart answered, “But when I was writing symphonies when I was ten, I wasn’t asking others how to do it.”

WB: We’ll carve up the portfolio and give it to a few people. I’ve done this before, in 1969, when I closed my partnership and recommended three other managers for my investors. I approached Charlie Munger, Sandy Gottesman, and Bill Ruane. Charlie was already rich and wasn’t interested. Sandy wasn’t looking for new investors, but took a few. Bill Ruane took most of them and put them in Sequoia Fund. My successor should have three attributes: He should be a great steward of capital; he should never get you into trouble; and he should get a great result.

I also did this before in 1979, when Lou Simpson came to GEICO.

Q: What do you think about global warming?

WB: The odds are good that it’s serious. It’s foolish to say that we’re 100% sure that it’s not a problem. It makes sense to build an ark before the rains come. We should err on the side of the planet. General Re is in the excess-of-loss business and the property business, and won’t be affected by the weather ramifications of global warming. National Indemnity writes catastrophe business. We think cat exposure is going up because of what’s going on in the atmosphere. The relationship between relatively small change in the climate and the effects those changes will have is not linear. A small temperature change could have a huge impact. We are plenty cautious. But this isn’t something that keeps me up at night.

CM: CO2 is what plants eat. I like it warmer. It’s not as if a flood of people are moving from Southern California to North Dakota. It’s not clear to me that it would be so bad to have the planet hotter. But the dislocation warming caused could be bad.

WB: But Charlie, water levels could rise by 15 feet.

CM: The Dutch did OK holding back water levels, given enough time and money. I don’t think that global warming is an utter calamity for mankind. You’d have to be a pot-smoking journalist to think that.

WB: Cat severity was high in 2004 and 2005. But Katrina is not anywhere near the worst case of what might happen. We don’t know all the factors that go into causing hurricanes. On balance hurricane season seems to be becoming more intense. It’s crazy to write cat insurance on the same terms as before. So global warming is a factor with us.

Q: Is the Chinese banking system vulnerable to disruption?

WB: I don’t know. It’s an important question. My insight into Chinese banking is zero. I just don’t know.

CM: All the big economic progress in China has been accompanied by practices of Chinese government banks that would make you shudder. They were doling out money in aid rather than making loans. It may be getting better now.

WB: We’ve had our share of banking problems in this country. Strong economies get through this stuff. The economy has come through lots of economic crises. Gains will continue to be made.

Q: What would you do if you were starting over with $10 billion?

WB: In 1969, prospective returns on stocks were the same as they were for municipals, looking out the next decade. That’s not the case now. If we ran a large endowment now, we would either be 100% in bonds or stocks or cash. We don’t believe in layering. If you asked me which would provide a better return over the coming 20 years, between bonds and stocks, I would buy stocks. It wouldn’t be a close decision, but we would rather buy stocks cheaper. But we don’t know where stocks will be in two years or five years.

CM: We think the current situation could be affected by big disruptions.

WB: But there will always be disruptions that can’t be predicted. We bought $5 billion in equities in the first quarter. It’s not like it was in 1974. We’d like to invest more, and hope we can do it in a big way.

Q: Why did you sell silver?

WB: We sold it to people who knew more than we did. We bought too early and sold too early. Other than that, it was a perfect trade.

CM: We have shown the world that we don’t know anything about the silver market.

WB: But we’re flattered that you asked. The price of silver responds to supply and demand. There’s not a lot of economic conspiracy behind it.

Q: What advice do you have to give to someone who’s planning to give it back in 20 or 30 years?

WB: You have the right time horizon. If your long-term goal is philanthropy, you are in effect an endowment fund. I’ve always said that I would have been foolish to give away money early on, since I have been able to compound money rapidly over time. When my wife had a baby, I called an obstetrician; I didn’t try to deliver it myself. When my tooth hurts, I go to the dentist. I don’t ask Charlie to fix it.

CM: If all Warren wanted to do is talk to grant applicants, we wouldn’t have been too successful over the years.

WB: I have everything in life that I want. When I gave away my Berkshire stock, I didn’t really give up anything. Other people change their own lives when they make big philanthropic gifts. They forego vacations, or give up huge amounts of time. I haven’t done that.

Q: If you were starting over, what would you do?

WB: If I were working with very small sums, I’d be doing other stuff than I’m doing now. The universe of alternatives expands dramatically. You have thousands of times more options. You can earn high rates of return with small sums of money. You can find value with small sums. At our size now, we can’t earn a phenomenal rate of return. We have to put $5 billion into a stock for the position to have meaning. It’s not even close. But if we were investing $1 million or $5 million, we could earn a high return on capital.

CM: But there’s no point in thinking about that now.

Q: What do you think about what’s going on in the subprime lending market?

WB: Lots of people borrowed money to buy houses that they don’t want to own anymore, or can’t make the payments on. Intermediaries and lenders will suffer. Will it spill over into other parts of the financial system? My guess is no. If unemployment doesn’t go up and interest rates don’t rise, I don’t see the subprime mess being a trigger for a wider financial contraction.

We’ve looked at the 10Qs and 10Ks of a number of financial institutions. A number are accruing earnings on loans even though the borrower is making only the lower option payment. I think it’s a case of dumb lenders lending to dumb borrowers. The growth in subprime was largely a bet that housing prices would keep rising. It worked until it didn’t. It’s similar to what happened to the manufactured housing industry in the 1990s. When supply expanded, some borrowers didn’t want to own the asset unless its price kept going up.

CM: Much of what happened was a combination of sin and folly. The accountants let lenders show profits when anyone in his right might would see that that was crazy. Historically, low-interest loans have gone to the “deserving poor.” That’s good. More recently people have been getting paid to get lenders to lend to the undeserving poor. When the guy who does that looks at himself in the mirror in the morning, he sees someone who is evil and stupid.

WB: On a lot of these defaulted loans, the borrower didn’t even make the first payment. Early-payment defaults shouldn’t happen. That happened in the late 1990s in manufactured housing. When loans are packaged and securitized and local lenders aren’t part of the process, discipline leaves the system. You’ll have some faraway institution making a loan on a piece of property, and the local lenders will know that it’s a crazy loan to make. But when those loans get securitized, discipline leaves the system. The overhang of bad loans hasn’t yet worked its way through the system. In some cases it will take a few years. The overhang is huge. People who thought they were flipping are the ones who are getting flipped.

Q: What do you think about managed-futures funds?

WB: The most logical investment is the one that we think makes the most sense. Anyone who’s limited to one segment of the market is at a disadvantage to someone who has total authority. We wouldn’t want to run a fund that was devoted just to stocks, or bonds, or futures. It’s a mistake to shrink your universe of possibilities.

It doesn’t matter if you’re set up as a hedge fund, or a mutual fund, or a private equity fund. The form doesn’t produce investment results. It depends on the manager.

CM: I think the return of the typical managed futures fund will end up being somewhere between lousy and negative. Usually funds like that are sales tools. Promoters will sell them until they stop selling. I think it’s a mistake to be sold “areas of opportunity.” Brains make opportunities, not areas.

Q: What are some of the areas of opportunity you see in the coming 50 years?

WB: Read everything in sight. If you’ve done your work, you’ll identify opportunities. We’ve seen some, missed others, and kept looking. We knew there were ways to make money. Just read everything you can find, 8-10 hours per day. But you can’t lay it out ahead of time. It’s not a road map, it’s a reservoir of opportunities. You’ll see a lot of things. But don’t do anything where you can lose a lot of money. It should never be two steps forward and one step back. Avoiding catastrophes will be important.

CM: The place to look early is at inefficient markets.

WB: Don’t try to figure out which drug company’s new-product pipeline is better, or where bond prices are headed. You’ll have no edge there.

The Resolution Trust Corp. was a great chance to make money. You had disinterested sellers (the federal government), no willing lenders, and prior buyers had all been cleaned out. There was an imbalance of intensity in the process. The government just wanted to be rid of the properties as quickly as it could, and there was no one there to buy them. There was no scarcity of opportunities.

Q: What do you think of the changes to the insurance system that Florida has put in place, and the Katrina-related litigation?

WB: Insurers will be reluctant to write more coverage if they think that the words on the policy won’t be honored. Yes, homeowners will be unhappy if their flood claims aren’t paid. Put the exclusions in very big type, so the homeowner will be sure to understand them. But if thousands of people sustain losses, courts and legislatures will want to stretch or abrogate policy terms.

It’s tough to ask people in Nebraska and Michigan to subsidize homeowners in Florida. If there’s a $150 billion loss in Florida, there will be calls for Washington D.C. to pay the tab. If that doesn’t happen, taxes in Florida are going to go up. How much should people who are not exposed to a risk subsidize people who elected to be exposed to it?

Q: Discuss the $5 billion in acquisitions you made in the first quarter. Have you changed your hurdle rate? Does this mean you’re giving up looking for elephants?

WB: I don’t think we’ve changed our standards. Then again, if you haven’t been out on a date for a month, can you say for sure that the girl you finally ask out, you would’ve asked out on the first day? I can’t say for sure.

We have plenty of money to put to use if we ever found an elephant. We would even sell stocks to raise more money if we had to. TTI, an electronics distributor in Fort Worth we bought is the kind of thing we want to own. It’s a terrific business. We can swing in and make a deal quickly.

CM: We won’t earn the kinds of returns we were making even five or ten years ago. It’s a different world.

Q: Why do you support Planned Parenthood?

WB: Planned Parenthood is a terrific organization. For years, millions of women all over the world were involuntarily bearing children, living under governments run by men. It’s a very important issue. If we’d had a Supreme Court made up of nine women when the country was founded, these questions wouldn’t even have come up.

Q: In investment theory, risk is defined by volatility. Why would a rational investor listen to the opinion of the marketplace?

WB: Volatility does not measure risk. Past volatility is not a measure of risk. It’s nice math, but it’s wrong. If a farm in Nebraska used to sell for $2,000 per acre, and now it sells for $600 per acre, investment theory would say that the beta of farms has gone up, and than they are more risky than before. If you tell that to people, they’ll say that that’s crazy. But farms don’t trade daily the way stocks do. Since stock prices jiggle around, finance professors have translated that into these investment theories.

It can be risky to be in some businesses. Risk is not knowing what you’re doing. If you know who you’re dealing with, and know the price you should pay, then you’re not dealing with a lot of risk.

We haven’t had a permanent loss that’s added up to a significant portion of our capital. We made a big mistake about Dexter Shoe. I was wrong about the business?but the problem wasn’t that the business was too volatile. We have invested in a lot of sectors that have high betas. The development of beta has been useful to people who want careers in teaching.

CM: In both corporate finance programs and most MBA programs, 50% of what they teach is twaddle. One reason we’ve done well is that we saw early on that smart people do dumb things. We want to know why. Who, too.

WB: We will not run big risks at Berkshire.

Q: What should I focus on in company filings to determine the quality of management, if I haven’t met management?

WB: We bought $5 billion in stock this past quarter, and I don’t know the management of any of the companies we bought. (If I buy a whole business, then that’s different. I care how management behaves.) But when it comes to investing in marketable securities, we read the reports. Charlie and I were talking the other day about a large oil company who’d just put out an annual report that’s more than 100 pages long. We went through it, and couldn’t find its finding cost per MCF?the most important piece of data investors should want to know. But it’s not even discussed. It’s like getting dishonest information.

You can learn a lot by reading CEO letters. If it seems like it’s been written by the P.R. department, that should tell you something. If a CEO can’t take the time to write a few pages once a year, then I’d have some questions. I like to get the feeling I’m being directly talked to.

We have bought some businesses that were run by mediocre managers, but we felt that the businesses couldn’t be screwed up.

CM: There’s a difference between the quality of a business and the quality of a management. If it’s a strong enough business, it should be able to withstand poor management.

WB: If you gave me the number-one pick in the CEO draft, and said he had to run Ford Motor, I wouldn’t do it. It would be too tough. A CEO depends on too many things happening that are outside his control, even if he’s the best in the world.

Q: In 1999 you wrote an article for Fortune that said that 17 fat years in the stock market would be followed by 17 lean years. How have things turned out?

WB: There was nothing magical about the number 17; I was just using a biblical analogy. If I had to choose between owning long bonds and equities right now, I would own stocks. I wouldn’t have high expectations, but they’d be higher than the 4 ¾% that long-term governments pay.

In 1999, people were extrapolating the recent past into their expectations. If I were writing that article now, I wouldn’t have high expectations for stocks.

CM: When Warren says, “modest expectations” for stocks, he’s got it about right.

WB: You can’t say something smart about the market every day, or every week, or every month. But every once in awhile things get really out of whack. The good thing is that you don’t have to do something every day.

Q: What is your position on removing PacifiCorp.’s outdated dam on the Klamath River in the Pacific Northwest?

WB: FERC and the local regulatory commission have 27 proposals in front of them. Some advocate hydro power, since it doesn’t cause pollution. Some advocate other types of generation, since they are cheaper. This is not PacifiCorp.’s decision, but rather FERC’s. It’s a tough decision. The state public utility commissions will listen to arguments. We are a public utility. We will respond to regulators.

Q: What do you think of the NYSE-Euronext merger?

WB: I don’t know the answer. Both exchanges were big before. Their combination should result in narrower spreads and a lower cost of execution. That’s good. The NYSE has gotten much more efficient over the past 30 years. We are satisfied. We get good executions around the world.

CM: I don’t know anything about it.

Q: How do I learn who to trust and not to trust in figuring out where to invest?

WB: A lot of the problem with many investments isn’t fraud, but rather fees and frictional costs. We have had good luck buying whole businesses. A lot of it is knowing how to filter out people. People give themselves away. What they say early on isn’t always important, but it will give clues to their subsequent behavior. Our batting average on people is about 90%.

CM: We are deeply suspicious when an offer is too good to be true. I remember one guy was selling fire insurance on a concrete bridge that was underwater. He said it was like taking candy from a baby.

WB: We get suspicious when a promoter says that his deal is “so easy,” and then laughs about it. It’s not easy. We look for guys we can clearly trust. We’ve probably passed on lots of good guys. I don’t like unfair fee structures, or like to hear “oh, I can get it for you at . . .”

Q: How do you come up with your discount rate?

WB: We don’t have discount rates. Charlie keeps reminding me I’ve never prepared a spreadsheet.

We want to earn more than the rate on Treasurys. But if the Treasury rate is 2%, 3% or 4% that isn’t good enough. If Treasurys are yielding 4 ¾% as they are now, we want more than that. I never ask Charlie, “What’s our hurdle rate?” It would be OK by us if they shut down the stock market for a few years.

CM: Hurdle rates make sense, but people go overboard with them. Just because you can measure something doesn’t mean you should let the math take over the whole process. That’s the trouble with hurdle rates. Hurdle rates don’t work as well as just comparing various alternatives. If I can earn 8% for sure, I don’t need to take two minutes to decide whether or not to invest in an alternative that yields 7%. It’s like deciding whether to marry a mail-order bride who has AIDS. The concept of opportunity cost is too-little taught. Maybe that’s because it doesn’t lend itself to complicated mathematics.

WB: I’ve sat on 19 boards. Every deal that every one of those companies did had attractive prospective IRRs as calculated by the bankers. The boards would have been better off if they’d burned all those slide decks. You get nonsense figures to support a story that the CEO wants to hear.

CM: One of my friends promotes commercial real estate investments. I asked him what returns he tells his investors he aims for. He says 20%. I asked him how he came up with that numbers. He said it’s the number that investors want to hear.

WB: If we hear promises like that, we run ‘em off. It’s amazing how gullible big money is.

Q: Is there anything that’s too tough that doesn’t go on the too-tough pile.

CM: Sure. If your child has a terrible disease, you can’t put that on the too-tough pile.

WB: If it’s an option we put it on the too-tough pile. But it’s not always an option. We hope there aren’t too many like that.

Q: How often do you review each position in the portfolio?

WB: Berkshire’s had two different periods in its life. When we had more ideas than money, we reviewed the portfolio a lot. Now we have more money than ideas, and the main option is cash.

Q: Have you thought about adding to your existing positions?

WB: Yes, we do think about it?and have. But in some cases we might hit reporting limits and position thresholds. We can’t cross certain thresholds. Adding to certain positions is always something we’re considering. We like to add when we can. These are companies we understand and like.

CM: It’s not as easy as it looks to buy big positions. When we were accumulating our Coca-Cola stake, we accounted for 30% to 40% of trading volume per day, and it still took awhile to build the position. There’s no easy way to move elephants around.

WB: We can do 20% of daily trading volume and not move the price around; more than that and the price is affected. So if we want to build a $1 billion position in a stock, $5 billion of it has to trade?which is a lot.

Q: Will you be willing to talk to the leaders of the tribe that’s affected by the PacificCorp facility in the Pacific Northwest?

WB: We won’t make the determination of what should be done. That will be made by FERC. The decision to go with wind vs. coal will be made by the commission. Any time a major decision is made in the public utility field, some groups are happy and some are unhappy. We will do exactly what FERC decides. Twenty-seven groups will present their views. The Department of Interior will provide some advice. It takes a lot of time.

Q: What effect will the Florida reinsurance legislation have on Berkshire’s subsidiaries?

WB: I’m going to ask Joe Brandon to address that.

JOE BRANDON: Florida recently expanded its public reinsurance fund. The effect will be to move private coverage to public coverage, which charges lower prices for wind risk. So the new law will have the effect of lowering prices. Florida is taking a big risk. It had earlier offered $18 billion in coverage. The new law raises that by $12 billion to $16 billion.

WB: Florida is going to have a big problem if a $150 billion hurricane hits. There won’t be enough money in the state fund to cover the losses. The state could float a big bond, or it could go to Washington to ask for assistance. A $100 billion storm is unlikely but could happen. Andrew was $30 billion. If there are no big hurricanes in a few years, the whole matter will die down. If there are big hurricanes, Florida will go to D.C., or sell some bonds, and taxes will go up. It’s tough to be where the wind blows a lot, but is a nice place to live.

Q: Who are your present-day role models?

WB: One thing I’ve been lucky with is that the role models I’ve had have never let me down. That would be a terrible situation?worst when the role model is a parent. Choosing your heroes is important. You should want to associate with people who are better than you are. Marry up and hope you can find someone willing to marry down.

CM: Some of the best people are dead. When you’re looking for role models, don’t limit yourself to the living.

Q: What are your views on ethanol?

CM: Running cars on corn is one of the stupidest things I ever heard of. Our government is under tremendous political pressure even though it makes no sense. The idea of subsidizing ethanol use is about as crazy a decision as has ever been made. We want to have a social safety net, yet we have a policy that has the effect of raising the price of food, in order to make driving an SUV cheaper. Manufacturing ethanol uses up as much hydrocarbons as using petroleum directly does.

Q: What are you doing to protect Berkshire from inflation?

WB: We don’t see metals as a protection against inflation. The best inflation protection is earnings power. If you’re a lawyer or a surgeon or are in some other profession, you can hedge with pricing power. Also, you can offset inflation if you own a wonderful business, like making Snickers or Hershey bars. Make something that people will pay for, in a business that doesn’t require a lot of capital investment. But inflation is bad for investors. Berkshire won’t do as well during times of high inflation as it would in time of low inflation?but it would do better than most companies.

Q: What are your views on railroads?

WB: It’s not the most exciting business, but railroads’ competitive position has improved versus truckers over the past 20 years, especially as oil prices have risen. Rising energy prices raises truckers’ costs four times more than they raise railroads’ costs. Not much new capacity is coming on line. It was a terrible business 30 years ago. The industry was regulated, and I suppose could be re-regulated some day. But it’s very capital intensive. It’s tough to earn high returns in a business that you have to invest heavily in regularly.

Q: What are the best ways a 10-year-old can earn money?

WB: Delivering newspapers was my favorite. I guess you have to be 12 or 13 to deliver papers. I must have tried 20 different businesses by the time I got out of high school. Owning a pinball machine was great. I read a study somewhere that correlated business success with various attributes, such as grades, or whether the individual went to business school. The strongest correlation of success was the age of the individual when he started his first business. That makes sense. You see it in music and in athletics, too. I’ve always wondered why people who are having debt problems don’t work a few extra hours a week and deliver papers early in the morning.

CM: There’s a book called The Richest Man in Babylon. It suggests to underspend your income, which is good advice. Also, give yourself the best hour of the day, to use however you wish. Sell yourself the best hour. If you make yourself a reliable person and stay engaged in what you’re doing it will be tough for you to fail.

Q: What rate of economic growth is sustainable?

WB: We’re in a group of good businesses in the world we face. Some are going to be big winners. Some will be OK. We don’t think a lot about global trends. We don’t like businesses that make products that have a high labor content that can be shipped here from overseas. High-cost operators have a problem. US Air’s cost per seat mile was 12 cents, while the industry average was 8 cents. We’re dealing from strength all the time.

CM: We learned about everything we needed to know about foreign labor competition after we invested in the shoe business. Will Rogers said, “I’d like to be able to learn to not pee on an electric fence without having to try it.”

Q: What are your views on the declining dollar?

WB: We think the dollar will continue to decline against most currencies. When we first became negative on the dollar, we bought $21 billion in foreign currencies directly. Then the carry on that position became negative, and it became expensive to own. More recently, we have focused on owning companies that generate non-dollar earnings. But the currency a company earns in is not a huge determinant as to whether we invest. It is a factor, though. The government’s current policies will likely cause the dollar to fall further. I don’t know the speed of the decline or when it will accelerate. But the fundamental forces are strong.

CM: A falling currency is supposed to be inflationary. During this recent period of the dollar’s decline, the inflation of prices charged by Costco has been basically zero. What matters is what happens to prices in your own country.

WB: Oil is denominated in dollars, so when the price of oil went from $30 to $60, to a European, the effect was as if it went from 80 to 135. The price of oil to a European hasn’t done much.

Currency matters more than people are used to thinking. Thirty years ago, the U.S. never had to think about its currency. That world has changed.

Q: How should boards of directors deal with managements?

WB: Most writers have a distorted view of how companies operate. Most directors were potted plants. CEOs didn’t want input. If someone spends 25 years working his way up, he’s going to want to be boss when he becomes CEO. There’s more governance process now.

By far the most important job for the board is to have the right CEO in place in the first place. If you were the board of Capital Cities, and you had Tom Murphy running things, case closed. Then you want to make sure the CEO isn’t overreaching. Finally, you want to provide judgment on major acquisitions. CEOs like to do big things spending other people’s money. By the time a proposed deal gets to the board, it’s a little game. The bankers always like the deal. The CEO will always stack the deck to make a deal look good.

On for-stock deals, the acquirer usually only thinks about what it’s getting, not what it’s giving. You have to be sure you’re getting as much as you’re giving up. But I’ve never heard a board discussion of what the company is giving up. Acquirers should be concerned about dilution. When I gave away 2% of Berkshire to get Dexter Shoe, that was one of the dumbest deals in the history of the world. It cost me 2% of the company. But that doesn’t show up in the accounting.

CM: M&A reveals the self-serving and delusional nature of good minds.

WB: The standard procedure is to trot in the bankers to present the deal to the board, and no one will argue the other side. It’s no contest. I don’t know how to change that. Our board is made up of people who are all big holders of the stock, which they bought on the open market. We don’t provide them with D&O insurance.

Q: Who would you choose as a partner on big deals?

WB: We normally don’t want partners. If we like the opportunity, we want it all. We don’t need money from partners. If we need a partner’s knowledge, we’re not too crazy about that, either. We have made exceptions. We did a deal with Leucadia that worked out great. They were a great partner. But they brought the opportunity to us. If we’re going to invest, we should understand the situation well enough on our own and not have to rely on partners.

Q: What is your long-term view on commodity prices?

WB: We have no opinion on commodities. If we own an oil stock, it’s not because we expect the price of oil to rise. If we wanted to bet on oil prices, we’d just buy oil futures. Posco is the best steel company in the world. We bought it between four and five times earnings. We like businesses that don’t require much capital. You can’t earn big returns investing in companies that require big capital investment every year. Low-capital businesses are far better than any steel or oil business. If anything, I have a bias against commodity-oriented businesses.

CM: We invest in businesses, not commodities, over time.

Q: What’s your advice to the New York Times Co. and the Sulzbergers?

WB: I wouldn’t blame the Sulzbergers for the troubles the newspaper business is in. We’ve said that many newspaper companies have been operated by people looking in the rear view mirror. We have dual classes of stock at Berkshire. I own 30% of each. But the woes of the newspaper business are not connected with the two voting classes of New York Times stock. The business has gotten a lot tougher.

Assume that Gutenberg had never invented the printing press, and that the news dissemination business originally evolved around the Internet and cable TV. If somebody came to you and said “I’ve got this great idea. Let’s start a business where we print the news on paper. We’ll run the printing presses all night, and distribute the papers with huge fleets of trucks, so that people can read about what happened yesterday.” Would you invest in that? But people’s habits die hard. The world doesn’t turn on a dime. Newspapers still have inertia on their side. The circulation of the Los Angeles Times used to be 1.5 million. Now it’s 800,000. I’m not sure there’s anything executives can do to change the situation. We used to sell 300,000 sets of the World Book every year. Now we sell 20,000.

The Buffalo News’s earnings are off by 40% from their peak?and it has one of the highest penetration rates of any major metropolitan daily.

CM: The dual class structure isn’t the problem. It was part of the basic contract when the company went public. The idea that shareholders want to change it now is crazy.

WB: When the New York Times went public, it said that it was committed to maintaining a high degree of editorial quality, and would spend lots of money to maintain that quality, even if earnings suffered. Everyone knows that the New York Times isn’t going to make huge editorial cuts so it can make its quarter. But look at how many papers in New York have disappeared over the years. Others had different management approaches than the Sulzbergers have. I’m not sure that in ten years, people will say that the New York Times played its hand badly. The Los Angeles Times will have a tougher time maintaining its editorial reputation than the New York Times will.

Q: The hall is packed, and presumably more people will attend next year’s meeting. Where will you hold it?

WB: We’ll have four new hotels opened up in Omaha next year, but you’re right. At some point we’ll hit a wall.

What do you think? Let me know!/MMS/

The author is an employee of bankstocks.com and an investment management firm. His fund often buys and sells securities that are the subject of his articles, both before and after the articles are posted. Under no circumstances does this article represent a recommendation to buy or sell stocks. This article is intended to provide insight into the financial services industry and is not a solicitation of any kind. Neither the author nor bankstocks.com can provide investment advice or respond to individual requests for recommendations. However, we encourage your feedback and welcome your comments on any of the articles on this site. Neither the author nor bankstocks.com has undertaken any responsibility to update any portion of this article in response to events which may transpire subsequent to its original publication date.

♂미스뷰티자마 (한) 2007 |

| |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| * NORTHERN DANCER 3S X 4D | NEARCTIC 4S X 5D |

| NATALMA 4S X 5D | * NATIVE DANCER 5S X 5D |

| * KRIS 3S X 4D | SHARPEN UP 4S X 5D |

| DOUBLY SURE 4S X 5D |

비가 많이 온다.

잠을 많이 잤다.

종합소득세 신고, 열심히 일하나 안 하나 환급 받는 세액은 똑같은.

엉덩이에 살이 없다.

의자에 앉을 때면 엉덩이뼈의 둔탁함이 느껴진다.

무슨 수로 살을 붙이지.

덥다.

개새끼들과 늦잠을 자고

맥주라도 한 캔 마실까 하다가

할 일이 많아서 생각을 접었다.

기마민족은

비가 오면 말을 탈 수 없기 때문에

우중에는 우울해졌다고 한다

나는 말을 타진 않지만

우울한 걸 보니

기마민족의 후예는 후예.

♂에린스아이즈자마 (한) 2007 |

| |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|